(Keep in mind that WiredWest would be handling most of these functions for the towns. It’s much more efficient to manage this regionally than having each town do it separately)

Leverett MLP Board/MLP Manager Meeting with Members of the Shutesbury, Wendell, New Salem, and Ashfield Broadband Committees

September 27, 2016

Important to understand that MLP and Town are separate entities legally and financially. Think of MLP as a stand-alone business that you are trying to operate – separate rules for operations etc.

Questions for Leverett Regarding Current Operating Expenses

Leverett put together estimates based on historicals- only one year worth of data

65% of operating expense depends on build cost (Leverett included ONT for every home and a fiber line for every buildable property)

- Road miles and how many potential subscribers – get a good rough estimate

- Leverettnet is a closed network – the MLP contracts out for services

- Leverett owns the domain name – the contracted ISP operates on the domain

PURMA and Insurance

Can you give a line item expense for each insurance category (general liability, public officials liability, etc.)

Can you make corrections to Appendix A? Shutesbury got this from PURMA.

What length of time is the standard PURMA contract and is there any flexibility?

In the pole attachment applications we are being asked by Verizon for the town to carry a minimum of $3 million insurance, which we have, but National Grid is asking for proof of $5 million in insurance (we don’t carry that much). What levels of insurance is Leverett required to carry by Verizon and National Grid?

- All insurance from PURMA; most important is the one that covers ice etc; doesn’t cover routine –that’s under maintenance ($23K for that insurance but does not include the dues)

- Need an MLP to become part of PURMA- straight forward (not a hard process) but PURMA board has to vote you in

- There are lots of choices; business liability etc.—we were covered as MLP members; the problem is that the town insurance wasn’t adequate; amount that any one person can access becomes too small. You as a town (MLP) have to decide what you want to pay for. Would we be willing to serve without the coverage—Leverett wanted higher insurance than that.

- $3M insurance- the town’s insurance policy covers our bond. Now the MLP has added more insurance on that. MLP covered from town and PURMA—lots of additional insurance (exact break out and details from Marjorie).

- Town took out pole attachment applications and the bond but the town isn’t paying for ongoing cost—the town did the build and managed and had to deal with the pole owners and then transferred the ownership from the town to the MLP. Network in custody of MLP—can do anything they want except sell it. Town can sell it. Cannot separate until construction is done- only THEN did the MLP become the “owner” of anything (MLP existed but didn’t do anything until after). Town auditor did the work to help here.

- $10K deductible

- Work with MAIA to determine insurance needs

Bond fee for poles

- Comes into effect if MLP goes bankrupt (will cover take down of all equipment)

- If something is on the pole and we are done – they can say they want fiber taken down etc and the bond will help make sure to take that down; new technology disaster scenario

Pole Rental

When do pole rental charges begin? Is this something we have to cover during construction?

Can we confirm who we pay/how we pay for jointly owned poles?

Your pole rental fee went from $18,000 to $12,000, what was the reason for this reduction?

- Leverett thinks they started paying when make ready was done- after make ready construction was done. Utilities sent them an agreement before the make ready and then they start paying and then they do construction and then we start paying pole rentals

- $18K to $12K—The budget line item for this in 2015 was more than 2016 because it had included the 2014 as well.

Jointly owned poles

- You have to pay both utility companies; pay each one half and half

- Verizon does not want joint agreements- two sets of papers to put through—Verizon deferred to WMECO who did the ride outs

Auditor

Who do you use for your Audits?

How often are audits conducted?

Is the frequency up to Leverett or is this a requirement of insurance or state?

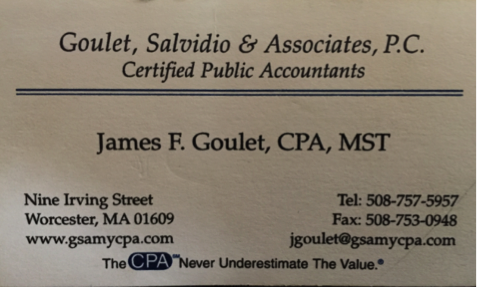

- Jim does MLP auditing—see business card below

General Administration

What is encompassed in GA? Who does it and who are they accountable to? How many hours per week etc.is it?

Are there other costs (e.g. Town Administrator, Treasurer etc.) that are not accounted for here?

- MLP cannot have cash; has to go through town treasurer (required by law) through separate account

- MLP operates on calendar year (different from fiscal year on which town operates) so all MLP contracts are for calendar year

- MLP is a stand-alone business and has its own rules for open meeting law and procurement – one example is that MLP board can sign long term contracts without town meeting approval whereas Selectboard has to receive approval at a town meeting before signing contracts that are longer than three years (i.e. Pole attachment agreements with utilities)

- Although MLP is not required to follow procurement process Leverett does do this for clarity and transparency.

- MLP has to do annual reports – relatively simple – Auditor handles these

- MLP Board can be elected or appointed by Selectboard (up to each town)

- MLP publishes policies on website – if there are changes they have ISP include a notice with the subscribers’ bills

- Two entities authorize payments out- town for town budget and MLP for MLP budget—town treasurer is only point of interconnection. (This was more work for the treasurer but only they are cleared to do this work—check out MA gen law 164- that defines all of the authorities etc for MLP. One section that authorizes communication.)

- Leverett collects 12 payments a year from the ISP for MLP OPEX

- Have separate Quickbooks for annual reporting- MLP manager runs that.

- Questions come in- some that we set polices around like setting up a new service (who quotes, what’s the quote is etc- MLP manages). Others like something doesn’t work then go to the ISP.

- Jack Ferriter – Holyoke — is a specialized MLP lawyer that Leverett uses.

Maintenance

Can you explain how the maintenance money flows and the contractual agreements? E.g. explain a break-fix scenario: who is responsible for identifying a network outage, diagnosing what the failure is, dispatching crew, performing repair, administering repair, accounting and follow-up. Who pays for what among all these actions?

How much of this is covered by insurance? What is the insurance deductible? Any comments on that?

Can you give us the numbers for maintenance costs from the first year to date?

- Network operator dispatches Collins Electric (separately contracted by MLP) maintenance contractor who sends MLP a bill

- No real payroll- Shrewsbury has a ton of people and full payroll for cable tv operation

- Make sure there is a clear tree of who calls who when and management on that e.g. dispatch to X

- Levels of maintenance vary – simple problems go to local electrician arranged by MLP

- Maintenance contractor charges are portal to portal so the farther away the contractor is located the higher the cost

- Be clear on what homeowners are responsible for- e.g. up to and including the optical network terminal belongs to town/MLP and is a town expense. If something on Ethernet etc that’s inside the house then it’s the customer expense. Homeowner digs conduit and breaks the fiber- Leverett’s maintenance contractor will fix but the customer will pay. Make sure you are clear on who pays but the work will still be done by one of the MLP contractors. Same as the phone company. MLP has a right of entry agreement with residents to access property to install and maintain on property- if you don’t have a right of entry then you cannot build to the house—need to have a contract on this.

- $10K deductible on PURMA all-hazards plant insurance.

- No different deductible for named storms

- 1 storm – 1 claim

- Routine maintenance — $60K is now the best guess we have for maintenance costs at this point, based on first year operation.

- MLP can do payments in lieu of taxes as a way to transfer money to town – that could work but it’s your MLP decision

- When maintenance expenses are higher than anticipated may have to do per cost recovery on bills, until new estimate of annual expenses is built into operating budget

Network Operator Fee, HG&E

How are the roles of these two companies delineated and who is responsible for holding each of them accountable to working with each other? If there was a dispute between Crocker and HGE re: responsibilities who would settle it?

- For the first year Leverett used HG&E (Network Operator) to handle maintenance, and now are using Collins. HG&E are still a backup. HG& E still is the network operator. Collins Electric, from Chicopee is the primary service company for serious maintenance issues, i.e.: broken cable. There is also a local electrician in Leverett who handles smaller jobs, i.e.: no power to an ONT.

- HG&E provide a range of services that we can tap into; Axia doesn’t deal with us- they deal with HG&E. That includes the cost for the middle mile.

- Contract with the network operator- you can see on the website how we present this. See public drop box (see link below under Resources) includes things like HG&E and ISP contracts.

- Axia won’t deal with the town- not a vetted service provider so we leverage HG&E here. Single largest cost is the backhaul here—Axia talks to the engineers rather than the Select Board. HG&E talks to them.

- There is a dispute resolution clause in the contract (MLP handles disputes between network operator and ISP); good checks and balances. They bring different skill sets so leverage them both.

- Split of responsibilities: Network Operator gets signal to hub in Springfield (middle mile, physical plant out here, etc.) THEN once it meets up in Springfield it connects to ISP

- HG&E deals with the equipment vendor (Calix)

- No annual fee from Crocker

- Had contract with Crocker one year before build completed

- Contract with Crocker is for 3 years

- Received 2 competitive bids this year for ISP –

- OTT Communications – they operate Granby MA Telephone (ISP Customers in Maine)

- Crocker

Legal

What questions should we be asking/ considering that you wished you had included from a legal perspective? Where do you suggest we build in flexible language?

You currently list your legal costs at $5,000 annually. Previously it was set at $10,000.

Was this expense higher leading up to and during the build, or was this adjustment due to budgeted vs. actual? If expenses were higher prior to first year of operation, do you have an itemization of these expenses?

- Haven’t had real legal issues- think about how you structure contracts from business perspective, not legal; lawyer vets contract language

- You can structure how you’d like- see examples on the Leverett drop box

- Leverett’s legal line in budget dropped from 10,000 to 5,000 because legal costs were not as high as expected

POP (Electronics Hut)

- You need climate control; suggest putting into an existing building- spent $200K to do the two buildings in Leverett. Didn’t have a place in an existing building that gave outside access to technicians. Need backup power (generator).

- This is a build cost but need to be clear that the choice you make impacts the operations.

- Prefab was much more expensive for them due to the building requirements and the crane/ insurance etc to get them into the property—cheaper to just build from scratch

Allowed Return (Contingency)

Why did Leverett use just 5% if 8% is allowed? Is this an annual amount of money that accrues each year? Can we change that percentage each year? Who decides that?

Do unused budget lines get to roll over each year and not be considered part of the “Allowed Return”? Also are budget lines able to moved around during the year? For example, in a given year you might have high electric bills and low legal expenses. Can the funds in those line items be moved around?

What was the reason that you chose to base this on OPEX instead of plant?

- MGL Chapter 164 allows up to 8% of total cost of deploying the Plant. Leverett uses this line as a convenient place to list and operating expense contingency of 5% pf projected operating expense. .

- Has to be balanced out with impact on MLP fees to subscribers and subsequently subscriber take rates (Operating costs paid by subscribers; build cost paid by tax bond).

General Questions

How much unpaid time and expertise goes into running the network (e.g. Committee meetings, Selectboard etc.)?

- MLP meeting 2x a month (current- may change) was weekly to daily earlier

- During build meeting daily

- Fluctuates dramatically

Who ultimately is responsible if something goes awry?

- MLP Board and the town because the town retains ownership of network

How does an MLP cover startup expenses before a steady revenue stream has been established?

- Leverett managed it through town but had some revenue from pre-subscription campaign

- Leverett had cash flow problems when the build took longer than expected. They happened to get their money from MBI at this time which covered most of the cash flow issues. Towns would need a different way to deal with this

- MLP can take out commercial loan or borrow from town

Are you paying a fee to the Utilities Telecom Council?

- No

How did your signups work?

- Subscription campaign done by Crocker as part of contract. Crocker gave 1 month ISP fee free to early sign ups.

- Note that MLP cannot give any freebies (i.e., provide service below cost) per law (subscriber promotions MUST BE DONE THROUGH ISP—Make sure this is in the contract negotiations)

- What percentage take rate did you have:

- when the network was first lit?

- 65% (but went to 80% within a month or two)

– at present?

- 80% (Crocker says this number is 84%)

- Leverett median tax bill increase to pay for bond for build is $219/year for 19 years; ½ this increase was offset by refinancing old town debt with new debt for fiber.

- Town is paying the General Obligation Bond (construction), since it is being repaid by taxes, there is less risk than if it were coming from subscriber revenues, therefore the bond market interest rate is lower.

- Leverett has 43 road miles

- Leverett has 1275 poles

- Count does not include service poles owned by homeowners

- tags=utility owned pole, no tags=homeowner owned pole

- Leverett installed an ONT on every home (with 2 or 3 exceptions) for a total of 811 ONT’s

- ONT’s have 8-16 hour back-up battery

- ONT’s in single family homes each have 2 connections (could handle accessory apartment)

- Multi-family dwellings have multiple ONT’s

- Houses need to have electrical utility connection to be connected

- If the customer puts a kiosk/shelter with power at the curb, could install ONT there, homeowner would be responsible for connecting it to the house.

- Leverett has no off the grid connections

- New owners do not need new Right of Entry as it is an easement that goes with the house

- New construction needs Right of Entry and charged approximately $2400 to install fiber drop and ONT – No activation fee

- Leverett documented buildable lots to assure network could accommodate future construction

- Houses can disconnect temporarily and reconnect – Crocker has no connect or disconnect fee – Crocker can decide whether or not to charge the MLP fee in the interim, but owes MLP fee to MLP regardless

- Leverettnet is not a public utility

- Leverettnet is not a phone service provider (lots of paperwork and responsibilities with that)

- Crocker provides phone service but is not a lifeline provider

- There is no statute requiring that every house has to have a lifeline provider

- MLP cannot offer reduced fee – has to be the same for everyone- towns could consider a Friends of MLP to provide financial assistance to those that can’t afford service

- Count does not include service poles owned by homeowners

Resources:

Presentation of the Leverettnet Municipal Model

https://wiredwest.net/2015s2/wp-content/uploads/2016/10/leverettnet-presentation_17-04-20.pdf

Leverett dropbox with historical documents, contracts, etc:

http://www.dropbox.com/sh/yw4lkp1b6wdh2zz/AACKpSL9uKG96sPUyT8RXhGva?dl=0

Jim Baller – Municipal Broadband clipping service:

http://www.baller.com/category/community-broadband/

Things you would have liked to have known or given more thought to prior to beginning your project:

- ADSS cables- does not require steel strand – may save on maintenance, because some maintenance issues caused by electric wire contacting steel strand supporting non-ADSS cable

- Can’t emphasize enough the role of a qualified project manager- really like HG&E

- Need someone to oversee every day to respond to change order requests and to watch for corner-cutting

- Their contract with Crocker stipulates that Crocker has to pay 1/12th of entire year’s MLP cost every month and anything they make above that is Crocker’s profits but Crocker is also taking on the risk of low subscribership.

- Be sure to include extra fiber at all town borders to allow connection with other towns for ring protection

APPENDIX A – PURMA COVERAGE

| Cost Item | Fixed/Variable | How to figure it out | Total |

| Insurance Membership dues | Fixed | (all towns pay this SAME amount for PURMA membership no matter what their size)

|

$1,200.00 |

| General Liability Insurance (including Terrorism rider) | Variable | Based on Revenue* Note that for most towns this will be $3100 because it is the absolute minimum annual premium for this item. If you are the same size or smaller than Leverett you can expect to pay at least this much.

|

$3,100.00 |

| Excess Liability Insurance(including Terrorism rider) | Variable | Based on Revenue* Note that for most towns this will be $3200 because it is the absolute minimum annual premium for this item. If you are the same size or smaller than Leverett you can expect to pay at least this much. | $3,200.00 |

| Public Officials Liability | Variable | Based on Revenue* Note that for most towns this will be $3000 because it is the absolute minimum annual premium for this item. If you are the same size or smaller than Leverett you can expect to pay at least this much.

|

$3,000.00 |

| Professional Liability | Variable | Based on Revenue* Note that for most towns this will be AT LEAST $3000 because it is the absolute minimum annual premium for this item. Leverett pays $5185

|

$5,185.00 |

| Property Insurance/Asset Insurance | Variable | Based on value of assets. This can vary by town based on many factors but a conservative estimate is around $175 per road mile.

|

$6,000.00 |

| Cyberliability (optional) | Variable | Based on number of served households – Leverett did not get this

|

|

| $21,685.00 |